Who we audit

Our main work is to perform audits of the financial statements of agencies. We audit around 170 agencies, including

SA Government departments, statutory authorities, public corporations and universities.

Our mandate

The Public Finance and Audit Act 1987 establishes the Auditor-General’s mandate. Read more about our mandate.

Our financial audits

We audit the financial statements of agencies every year in line with Australian auditing standards.

We plan and perform audits to obtain reasonable assurance that the financial statements are free from material misstatement. This is provided in the form of Independent Auditor’s Reports that give the Auditor-General’s opinion on whether the financial statements are a true and fair view of the financial position and financial performance of each agency.

We apply a risk-based approach to these audits and design our procedures to address these risks. We consider the internal controls that the agency has put in place to support the proper processing of transactions. We examine, on a sample basis, evidence supporting the financial statement amounts and disclosures. We evaluate the accounting policies and significant accounting estimates, and consider compliance with accounting standards and legislative requirements, including the Treasurer’s Instructions.

The outcomes of these audits are reported to Parliament. The larger, more significant audits are normally reported in our Annual Report to Parliament which is tabled in Parliament in October each year. All other agencies are reported in updates to this report, published when the audits have been completed.

While our financial audits mostly relate to general purpose financial reports, we also perform other audits like Commonwealth certificates and special purpose financial statements.

Extended reviews

Extended reviews build on financial audits and consider matters of public interest. They provide insight on good practice, control weaknesses and risk exposures that all agencies should consider in managing their business.

We normally report on these extended reviews in our Annual Report to Parliament.

Controls opinion

A collective opinion is provided on whether the financial controls exercised by the Treasurer and public authorities are sufficient to provide reasonable assurance that financial transactions have been conducted properly and in accordance with law.

This opinion is important because sound internal controls help safeguard public resources, promote accountability and compliance with laws and regulations. Poor controls hinder achieving objectives, legal compliance, and increases the risk of fraud.

We cover controls over areas we consider are material to the collective operations of agencies. We consider materiality from a quantitative and qualitative perspective to help identify areas that we believe are of interest to Parliament and the public.

In performing our work for this opinion, we use relevant criteria to assess whether controls are consistent with established standards of financial management practice and behaviour. The primary sources of these criteria are laws, regulations, instructions (such as Treasurer’s Instructions) and agency policies.

We report our controls opinion findings in Part B of our Annual Report to Parliament.

How we work with agencies

We actively engage with agencies before and during an audit and discuss significant findings with their representatives. To ensure transparency and procedural fairness, we provide our clients with written advice about our findings and recommendations and invite the client to respond to these before publishing our reports.

Regular and open two-way communication is critical for an efficient and effective audit. It enables an open relationship between both parties to collaborate on issues arising in the audit.

An engagement leader and audit manager will oversee each audit. They will meet with the agency early in the audit to establish a positive and open relationships.

We communicate by:

- meeting with senior management at the start of the audit to talk about its arrangements, scope and reporting time frames. We will arrange meetings with agency staff as needed in the audit’s planning, conduct and reporting phases

- attending audit committee meetings (or equivalent) when appropriate

- issuing letters that outline the audit engagement process, strategy and outcomes from the audit, including the Independent Auditor’s Report

- requesting further information required for the audit.

Before we report our findings to Parliament, we perform a robust procedural fairness process to confirm the factual accuracy of them. This process includes:

- providing draft findings to the agency’s nominated staff to review before meeting with them

- discussing the factual accuracy of our findings

- attending meetings with leadership and audit committees (or equivalent) to respond to questions about our findings

- providing draft report commentary to the agency’s nominated staff for review before we finalise the report to Parliament.

Where there are audit delays or when significant matters arise, we will relate with the agency's senior leadership, particularly in finance, to quickly resolve the matter.

What information we may need

For us to effectively perform our audit, we will request a large volume of documents as evidence. It is sometimes necessary to request documents that were provided to us previously so that we can confirm that things have not changed. We work with the agency to securely transfer this information.

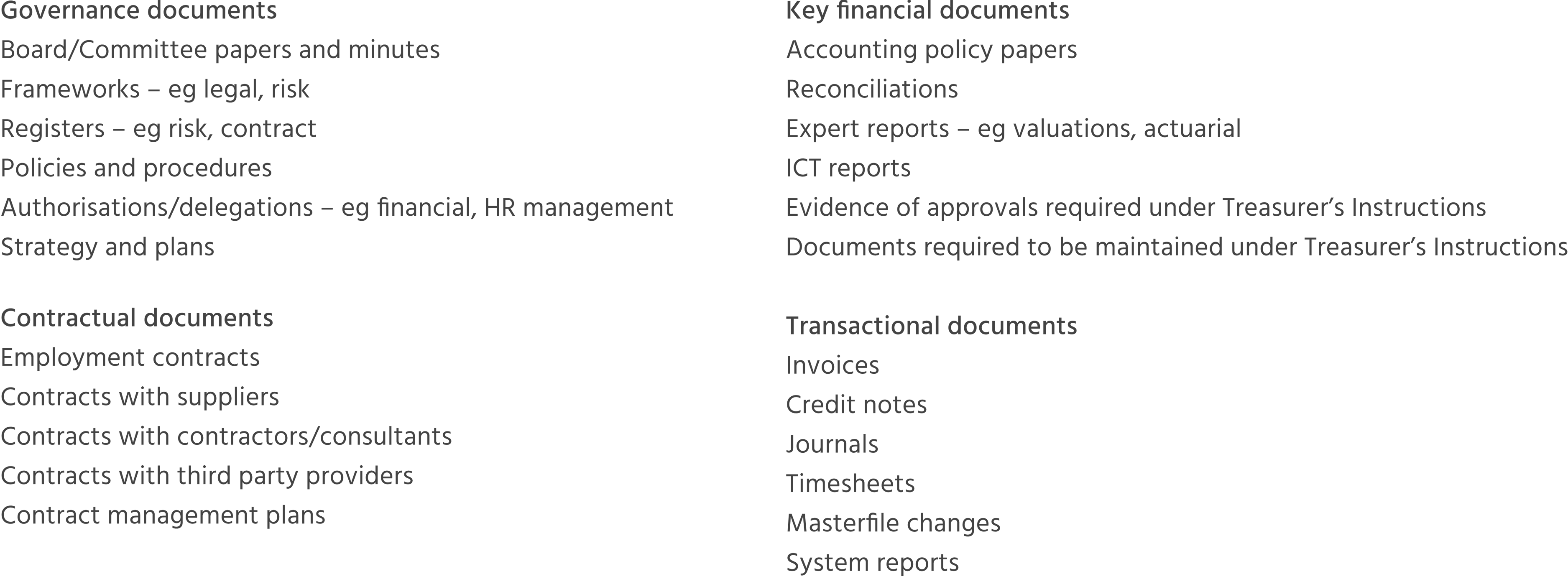

These are some of the types of information we may need. It will vary depending on the audit’s size, complexity and risks. It is a guide and not an exhaustive list.